– CHANGES COMING –

Graceful Transitions At The Firm

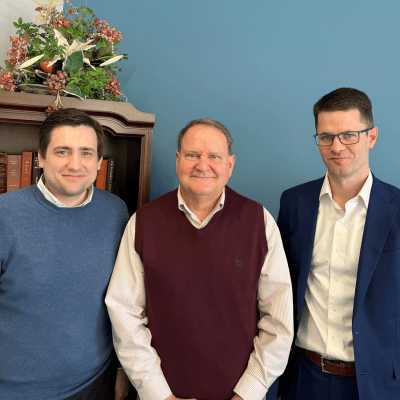

Estate Planning Attorneys, Stephen Wallace and Justin Wedgewood join Founder, Tom Downs, as owners of Downs Law Firm.

Estate Planning Law Firm Laurel, Maryland

Serving clients in Prince George's, Howard, Montgomery, and Anne Arundel Counties

Guiding Graceful Transitions and Preserving Legacies

Putting a plan in place for your family to manage things if you become disabled or at your death is an important act of love.

Unfortunately, all too often, people postpone planning for too long, or take insufficient steps to protect those they care most about, and instead leave them a series of tragic unintended consequences.

Since 1995, our Laurel estate planning law firm limited our practice to helping clients address these important concerns with carefully crafted estate plans.

We strive to help families go through these difficult life events with graceful transitions that preserve relationships, foster family harmony and provide wise stewardship.

We have assisted thousands of clients with creating Wills and Living Trusts, along with Health Care documents and Powers of Attorney.

We now spend a significant portion of our time assisting our clients’ families implement their plans when needed. We focus on the administration of trusts and estates.

If you want the peace that comes with taking appropriate action, our Laurel estate planning law firm would be glad to meet with you and discuss how we can work together. You can book a free, 15 minute phone call with me here.

In 1995, Tom Downs limited his practice of Estate Planning, Probate, and Trust Administration. Stephen Wallace and Justin Wedgewood joined Tom as owners of the firm in 2025. The firm is dedicated to helping families in the Baltimore-Washington Corridor plan effectively for incapacity and death and assisting with the wise stewardship of assets.

Our team can help with...

Planning for Federal Employees

Federal employees, whether in Civil Service Retirement System (CSRS) or Federal Employees Retirement System (FERS), have significant benefits that should be addressed in estate planning. Our firm has worked with federal employees for many years and can help insure your goals are achieved.

Planning for Grandchildren

When creating an estate plan, many of our clients take into consideration the legacy they want to leave for their children and, specifically, their grandchildren. Our firm can help you create an estate plan that protects and provides for one of life's greatest treasures, your grandchildren.

Planning for Military Members

Military members may have wills and related documents prepared by their JAG office. However, if they want to protect assets, avoid probate, or coordinate retirement and life insurance benefits, a private local law firm may be a better option.

Caring for Aging Parents

As parents get older they begin to face new challenges and hurdles, including paying for long-term care. Long-term care is expensive and can cause strain on family relationships. Getting a plan in place for caring for your aging parents helps to ensure that your loved ones get the care they need and that your family relationships are preserved.