What is Probate and Should you Avoid it? Part IV

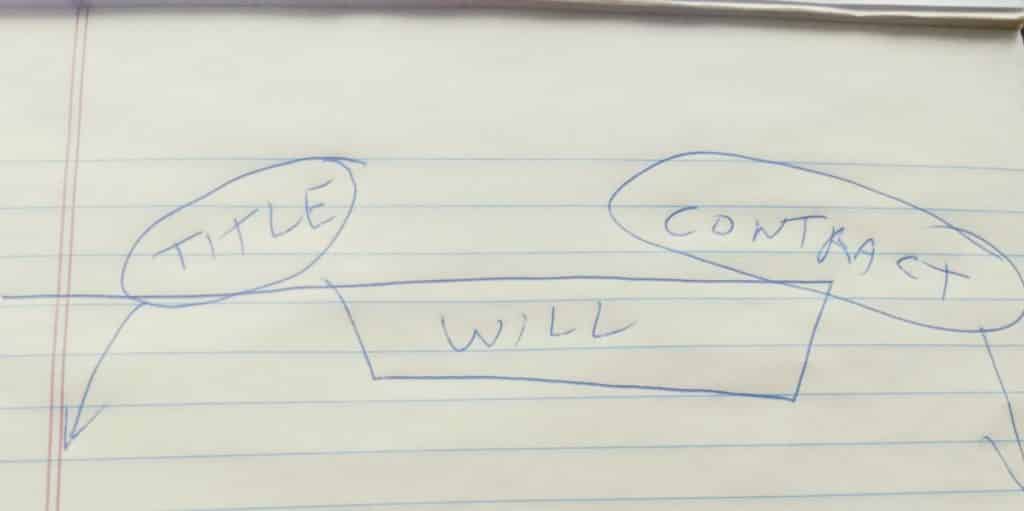

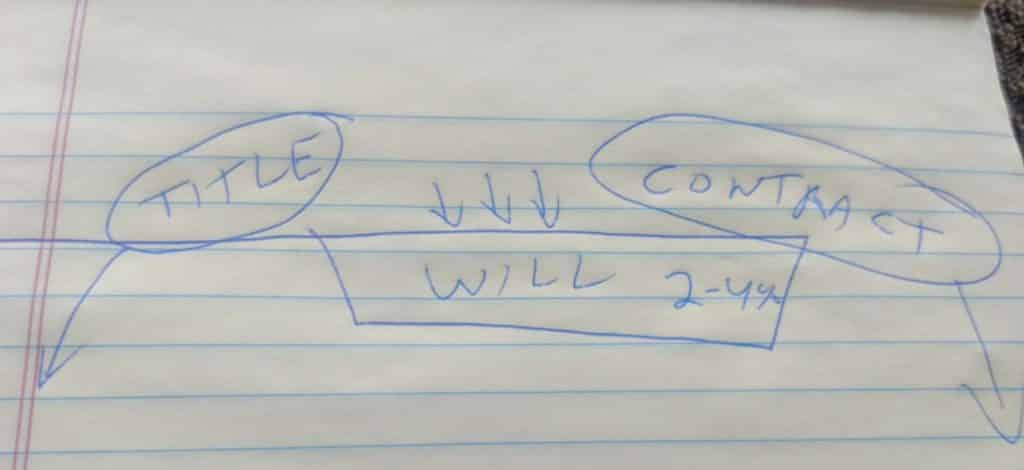

Probate is what’s left over At the end of the day, there may be some things left over to go through probate, meaning they didn’t avoid the process by title or contract. What’s so bad about that? I don’t know that there’s anything so terrible about probate. It is a necessary process to transfer title of property if no other options have been exercised. People who I have worked with in the Probate Court are generally helpful and dedicated. The Court imposes deadlines which make the case move through the system. However, the two main reasons people want to avoid the probate court, or any other court process are money and time. I often here attorneys say that probate is not that bad in Maryland. Actually, I only hear attorneys say that. In Maryland there are various court costs, bonding fees, probate fees, and attorney’s fees as well as Personal Representative’s commissions. The highest of these fees are often attorney’s fees. What’s so bad about that? The allowable fees for attorneys and Personal Representatives are combined is about 3.6% of the assets. For example, suppose the deceased person has a house worth $300,000 and a mortgage of $250,000, which figure is used to calculate the allowable fees and commissions? The formula is based on the gross assets, not the net assets. The allowable commissions and fees for a $300,000 probate are $11,880. In this example, the allowable fees are 24% of the net value ($11,880/$50,000). I generally estimate 2% to 4% as the administrative expenses for most families in probate. Additionally, probates ordinarily take somewhere between 9 months and 18 months to complete. If assets are complicated in nature, the time could be much longer. For small Estates, meaning under $50,000, the process can be much shorter. An additional reason some of my clients want to avoid probate is that your Last Will and Testament is a public record. Someone going to the Courthouse can read your Will, see the values of all the assets passing through the court system, learn the timing of distributions, and find out who gets what and when to they get it. This is more information than some many of my clients want to share with the public.