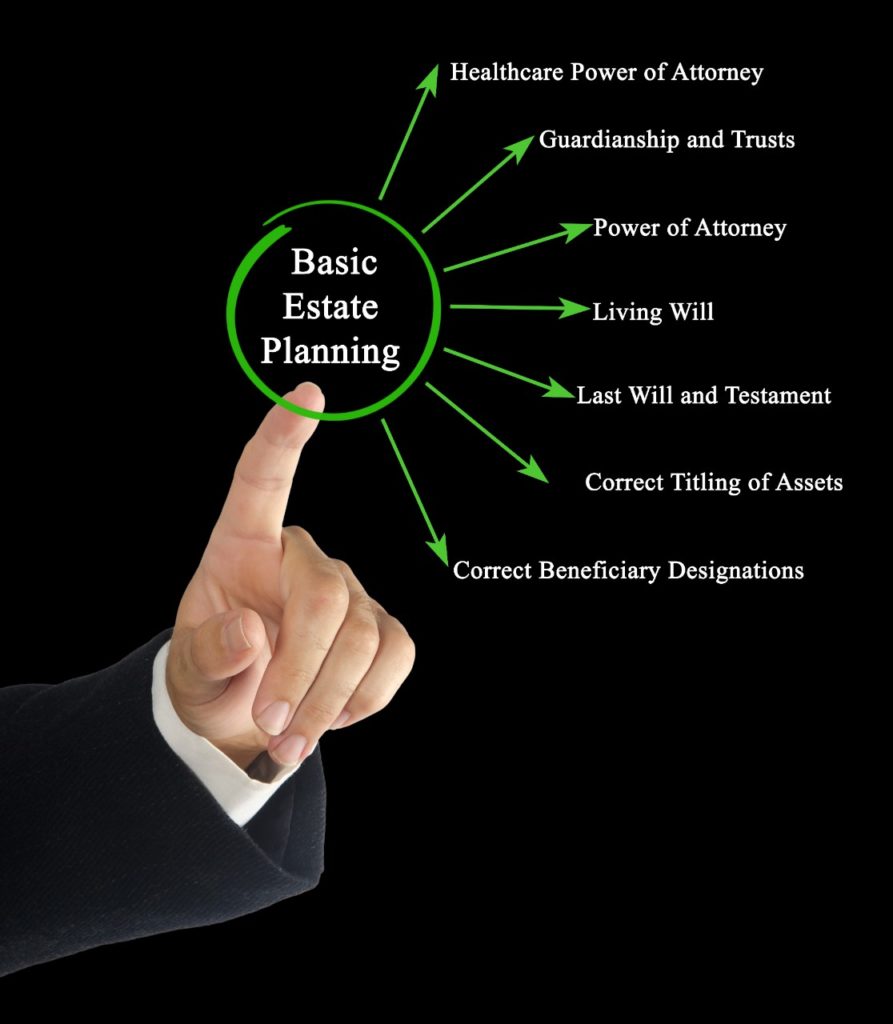

Top Reasons To Have A Will

In the realm of estate planning, a common adage rings true: “Failing to plan is planning to fail.” As an experienced estate planning attorney, I’ve witnessed firsthand the turmoil and heartache that can ensue when individuals neglect the crucial step of…