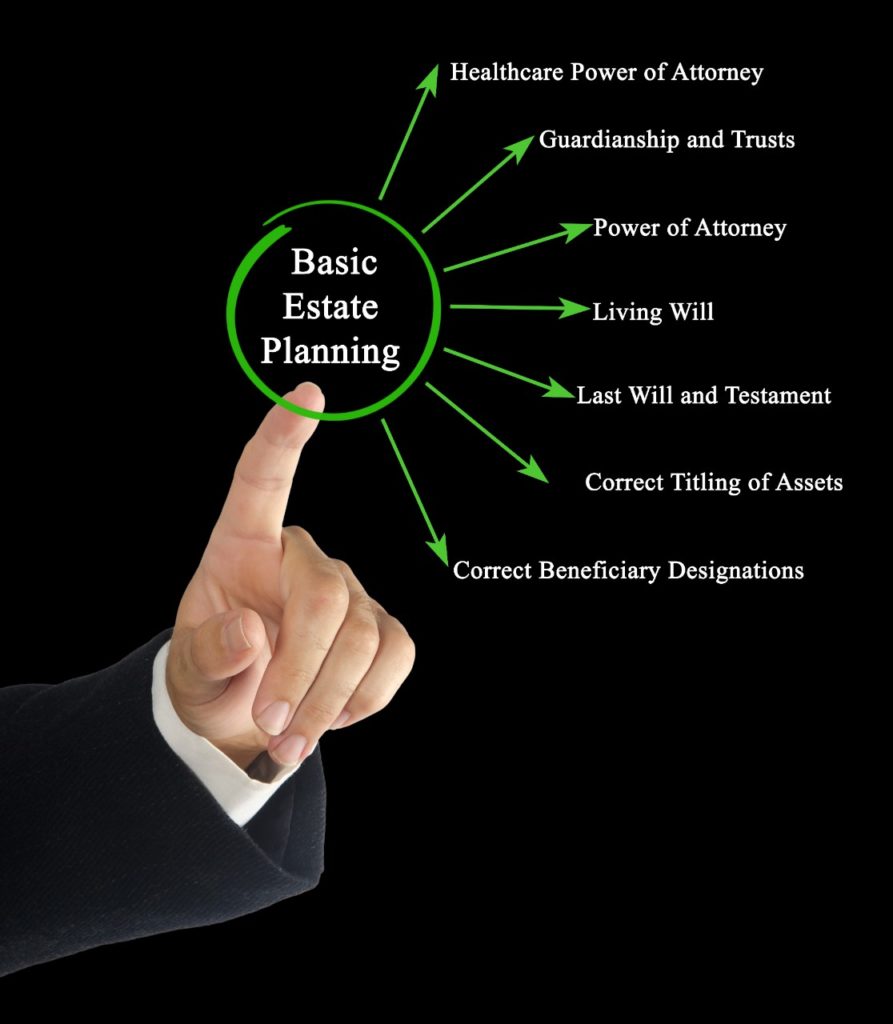

Forbes’ April article entitled “6 Parts Of Your Estate Plan You Should Review Now” discusses several items in your plan that should be examined in light of the coronavirus pandemic.

In this pandemic, who will make important financial and medical decisions for you if you’re unable to make them for yourself?

Make certain that you’ve designated a person who is trustworthy and reliable. Don’t forget to name a back-up for your power of attorney and health care proxy.

Look at your will. Make sure the person you’ve named as the executor, sometimes called the personal representative, of your estate is current. This is the individual who’ll attend to your affairs after you die and take care of probating your will if necessary. She will also file income and tax returns on behalf of the estate. If you have minor children, you should name a guardian for them in the will.

Review your trust. Your revocable living trust usually benefits you while you’re alive. It can also be used to benefit others, such as a spouse and children. Name those who will receive the assets at your death. If your beneficiaries are minors or not mature enough to handle a sizable sum, you might hold assets for them in trust until they’re old enough to handle the money themselves. Review your decision regarding your successor trustee to see if this is the right person to administer the trust according to your wishes.

Be sure to fund the trust. This will avoid probate of the assets on your death and lets the successor trustee control the assets for your benefit if you’re incapacitated. If you fail to do so, it will create a host of problems after you’re gone. Your heirs will need court authority to access your assets, which can be an expensive and time-consuming endeavor.

Update your beneficiary designations. This includes the beneficiary designations on your life insurance policies, retirement accounts, and any bank or brokerage accounts that are payable on death to a beneficiary.

Ask your estate planning attorney about taking advantage of estate tax opportunities. It is important to have everything in order in the coronavirus pandemic.

Reference: Forbes (April 15, 2020) “6 Parts Of Your Estate Plan You Should Review Now”