Living trusts are financial management tools that allow someone (the “trustee”) to hold assets on behalf of a beneficiary. Living Trusts can be drafted in a variety of ways and can specify exactly how and when the assets pass to the beneficiaries.

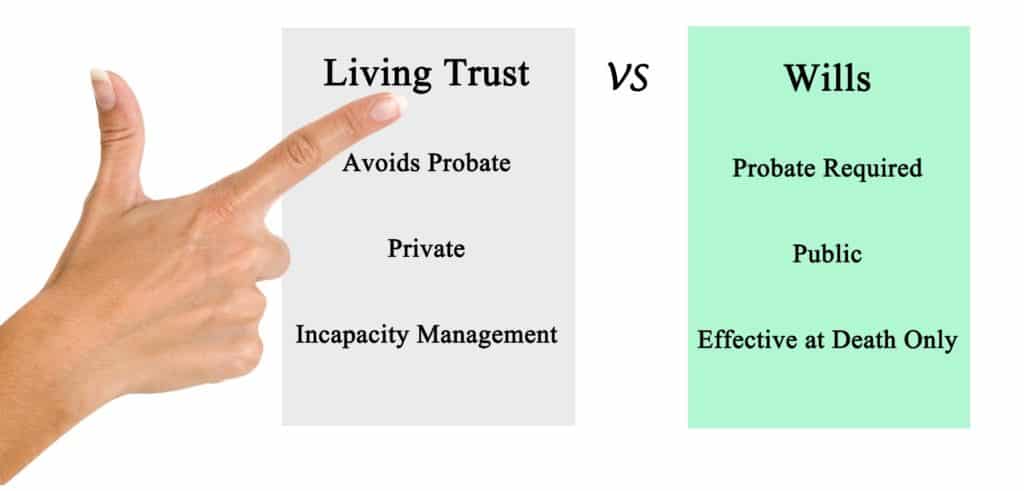

Because assets titled to living trusts avoid probate, the beneficiaries can get access to these assets more quickly than they might if the assets were transferred using a will. It also in not part of the public record, unlike a will, so planning can remain private.

FedWeek’s recent article, “The Basics of Trusts,” explains some of the benefits of having a living trust in your estate plan. Trusts can offer the following:

- Protection for possible incompetency. You can form a trust and transfer your assets into it. You can be the trustee, and you’ll have control of the trust assets and keep the income. A successor trustee will assume control if you’re incapacitated.

- Avoiding probate. The assets held in trust avoid probate, which can be expensive and time-consuming. In the trust documents, you can direct the trust and provide how the trust assets will be distributed at your death.

- Protection for heirs. After death, with specific instructions in the trust document, a trustee can keep trust assets from being spent all at once or lost in a divorce.

A living trust can be revocable or irrevocable. A revocable trust has to be created during your lifetime. If you change your mind, you can cancel the trust and reclaim the assets. With a revocable trust, you can enjoy incapacity protection and probate avoidance–but not tax reduction. In contrast, an irrevocable trust can be created while you’re alive or at your death. A revocable trust becomes irrevocable at your death.

Assets transferred to an irrevocable trust during your lifetime may be shielded from creditors and divorce settlements. It may also allow assets to not be considered as available resources for someone going to a nursing home, if set up more than five years before a Medicaid application is filed.

Your heirs can be the beneficiaries of an irrevocable trust. The trustee you’ve designated will be tasked with distributing funds to the beneficiaries. The trustee will be responsible for protecting trust assets.

Contact an experienced trust attorney with your questions about possibly creating a living trust for your situation.

Reference: FedWeek (May 9, 2019) “The Basics of Trusts”