Trust funding is a crucial part of estate planning that many people forget to do. If done properly with the help of an experienced estate planning attorney, trust funding will avoid probate, provide for you in the event of your incapacity, and save on estate taxes, says Forbes’ recent article entitled “Don’t Overlook Your Trust Funding.”

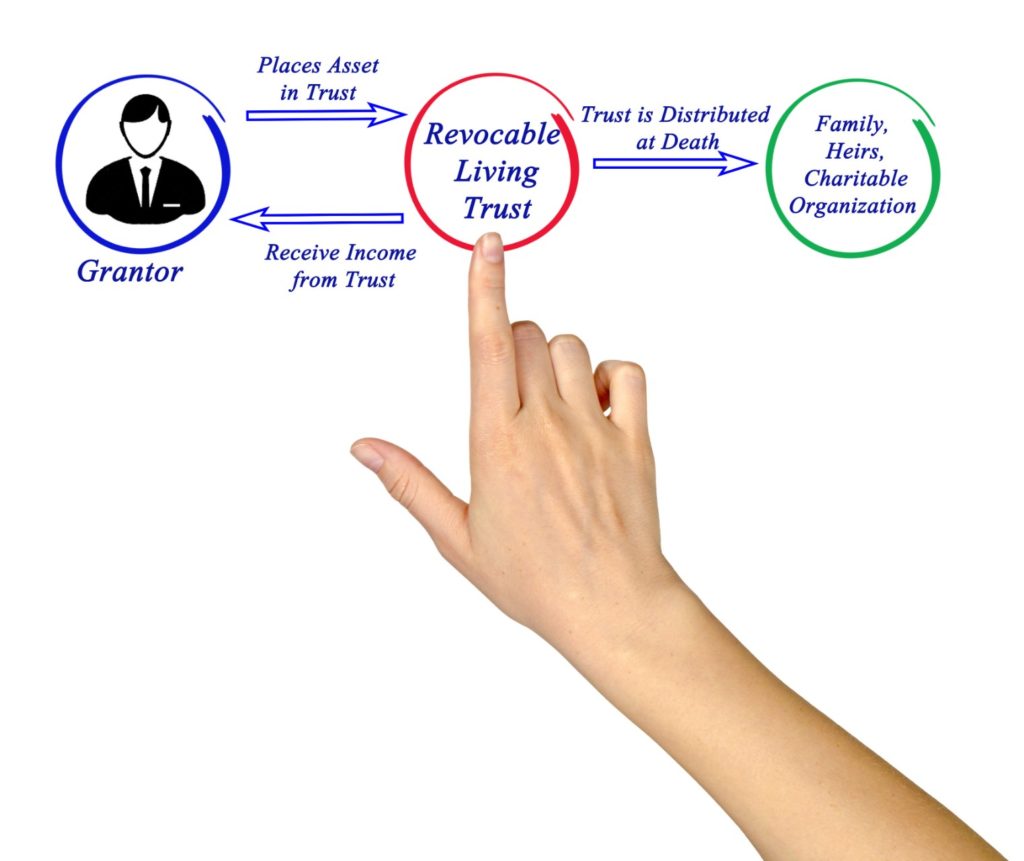

If you have a revocable trust, you have control over the trust and can modify it during your lifetime. You can also fund the trust while you’re alive. This will save your family time and aggravation after your death.

You can also protect yourself and your family if you become incapacitated. Your revocable trust likely provides for you and your family during your lifetime. You are able to manage your assets yourself while you are alive and in good health. However, who will manage the assets in your place if your health declines or if you become incapacitated?

If you go ahead and fund the trust now, your successor trustee will be able to manage the assets for you and your family if you’re not able. However, if a successor trustee doesn’t have access to the assets to manage on your behalf, a conservator may need to be appointed by the court to oversee your assets, which can be expensive and time consuming.

If you’re married, you may have created a trust that has terms for estate tax savings. These provisions will often defer estate taxes until the death of the second spouse by providing income to the surviving spouse and access to principal during their lifetime. The ultimate beneficiaries are likely your children.

You’ll need to fund your trust to make certain that these estate tax provisions work properly.

Any asset transfer will need to be consistent with your estate plan. Ask an experienced estate planning attorney about transferring taxable brokerage accounts, bank accounts, and real estate to the trust.

You may also want to think about transferring tangible items to the trust and a closely held business interests, like stock in a family business or an interest in a limited liability company (LLC).

Reference: Forbes (July 13, 2020) “Don’t Overlook Your Trust Funding”